SURE programme: a detailed financial analysis

The EU is set to become the largest supranational bond issuer in the world thanks to its €90bn billion instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE) and €750bn Next Generation EU (NGEU) recovery fund.

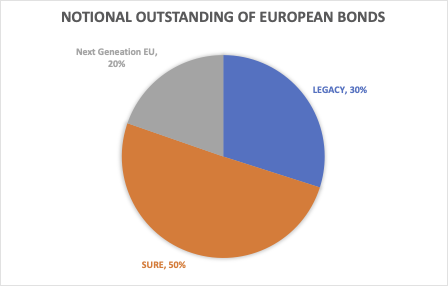

If we look at the distribution of bond notional issued by the European Union outstanding as at the end of June and we divide it between SURE, NGEU and legacy programmes (mainly for loans to Ireland and Portugal during the last debt crisis) we can see that the SURE programme (now concluded) represents almost 50% of total with NGEU already representing 20%.

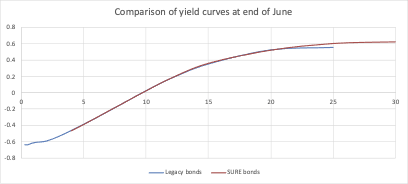

This significant amount of new bond issued on the market doesn’t present a material liquidity spread if we compare the Legacy vs the SURE yield structures.

Because of its material significance in terms of notional issued, we will analyse the financial aspect of the SURE program in the rest of the article. The plans to mitigate Unemployment Risks in an Emergency financed through the SURE program nor the social characteristics of the bonds issued will be part of an upcoming article.

The SURE instrument was created by the European Union (EU) to help Member States protect workers’ jobs and income during pandemic. It gave such a financial assistance in the form of loans with favorable conditions to the Member States. Each Member State that benefits from financial assistance under SURE was in fact required to sign a loan agreement with the Commission laying down the characteristics of the loan. Most of the loan agreements were signed in the third quarter of 2020, which enabled the Commission to issue SURE bonds starting from October 2020.

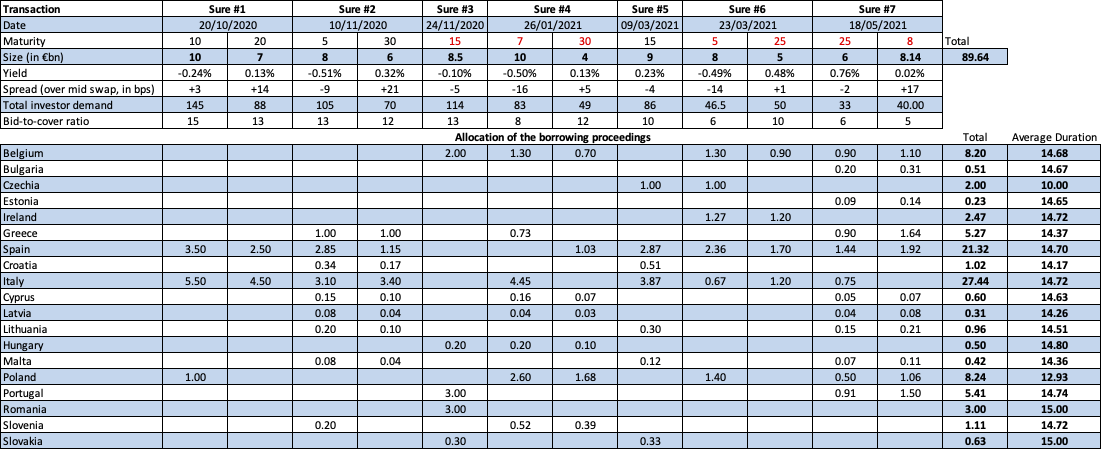

The agreements guarantee that the loans between the Commission and the Member States are in back-to-back, meaning that the Commission borrows on behalf of the Union and then lends to Member States at the same conditions. In the tables below we report the results of the Commission borrowing (table on the top) and how the proceedings have been distributed to the different member states.

From the table we can notice that:

The first SURE transaction represented largest ever order book (€233 billion) for any deal in the history of the global bond markets.

The major beneficiaries of the SURE program were Italy (€27.44bn) and Spain (€21.32bn) who have borrowed almost 55% of the total funds available

The average duration of the loans between each Member State and the European Commission is around 15 years with only Czechia having borrowed at 10 year

The countries whose debt trades at yields below the European Union one (eg. Germany, Austria, Netherlands) or the ones that have a very similar level of yields (eg. France) have not accessed the programme because it was not financially advantageous for them

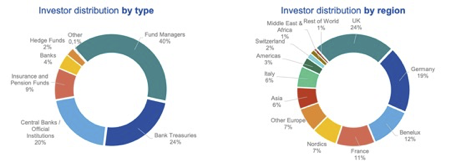

The bonds have attracted a significant of interest from the investors, especially for the first tranches: a very healthy average bid-to-cover ratios around 10 highlights the appetite for a AAA security that prices higher yields than Germany. The biggest majority of the investors where fund managers, as described in the graph below

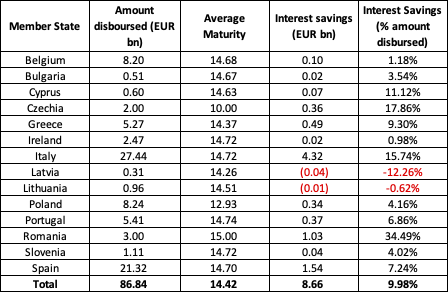

Because of the back-to-back lending structure, the loans disbursed under SURE generated interest rate savings for the vast majority of the Member States as the Commission was able to obtain favorable terms on the capital markets. To compute the savings, it is assumed that, in the absence of loans from SURE, Member States would have issued bonds with the same characteristics (i.e. maturity and coupon) as the EU SURE bonds on the day the loans were disbursed. The difference in yield between the government bond on the secondary market and the bond issued by the Commission is multiplied by the maturity of the bond and the notional of the back-to-back loan. We summarise the results of the analysis in the table below.

Here are the main takeaways from the table:

Italy saves the most interest rates (€4.32bn). This amount represents half of the total savings locked through the SURE financing project by all the Member States.

The country that saves the most interest rate as a percentage of the amount disbursed is Romania. This is because it received only a 15 year €3bn back-to-back loan. On the long maturities, total interest savings tend to be higher than the product of the average spread and the average maturity. The spread and the maturity are generally positively correlated, i.e. EU SURE yield curves tend to be flatter than national yield curves.

The Member States that benefited more from the SURE programme were Italy, Spain, Romania and Greece. Looking at the programme from this perspective evidences in a very effective way that this was first time a EU programme is directed not proportionally to the population of the and addresses the Countries most in need.

The SURE programme hence represents a win-win for the European Union (who has now established more firmly its presence on the capital markets) and the Member States (who have recorded significant interest rate gains). It paved the way to an instrument like the NGEU which is going to re-interpret the back-to-back lending structure in light of the new grants offered to Member States. “The successful SURE programme which served as a kind of test run makes us confident that the NGEU bonds will meet both our and the investors’ expectations” said Johannes Hahn, European Commissioner for Budget and Administration. We’ll analyse the NGEU programme in future articles.